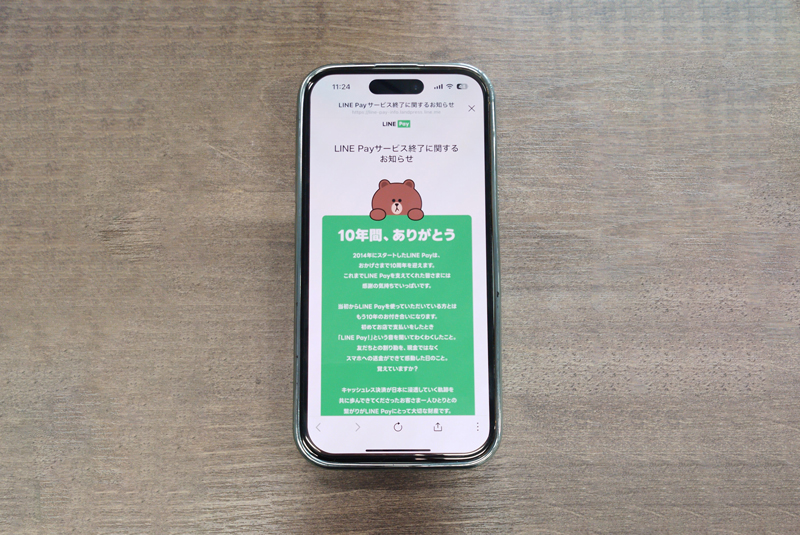

In a significant development, LINE Corporation has announced that it will terminate its LINE Pay services in Japan by the end of April 2025. Here’s a quick guide for existing customers and a great alternative for those seeking a new payment option!

Existing LiNE Pay Customers

LINE Pay Balance- Your Options!

Here’s what you need to know about the transition and what happens to your LINE Pay balance.

1. Transfer LINE Pay balance to PayPay Account

Users will have the option to transfer their LINE Pay balance to a PayPay account if they wish. LINE will provide a feature for this balance transfer, with more details to be announced on a dedicated website towards the end of February 2025.

2. Withdraw LINE Pay balance by April 2025 (Requires Identity Verification)

Until the end of April 2025, LINE Pay users can withdraw their balance as usual via bank transfer services, Seven Bank ATMs, or registered bank accounts. However, identity verification must be completed by late December 2024 for withdrawals between January and April 2025.

3. What if a balance remains after LINE Pay service termination?

After the termination of LINE Pay services, any remaining balance will be refunded in accordance with Japan’s Payment Services Act. Specific details will be provided on a dedicated website to be provided by LINE Pay.

LINE-Issued Card Services

Here’s a quick guide to what happens (or has happened) to LINE Pay card holders.

1.LINE Pay Card (JCB) – services already terminated

The LINE Pay Card (JCB) was a prepaid card used with a pre-charged amount. The card ended its services on October 31, 2023, regardless of the card’s expiration date.

2. Visa LINE Pay Prepaid Card- ending late January 2025

The Visa LINE Pay Prepaid Card, a virtual card issued through the LINE app, will cease its services in late January 2025, regardless of the card’s expiration date.

3. LINE Credit Card/LINE Credit Card (P+)

These cards will remain usable until their expiration dates on the card, even after the end of LINE Pay services. Further details on changes or termination dates will be announced later.

Seeking an Alternative to LINE Pay?

Introducing MobalPay: A Prepaid Card for Foreign Residents

As LINE Pay services wind down, foreign residents in Japan have a new alternative with the MobalPay card. This Mastercard-branded prepaid card is designed specifically for non-Japanese residents. Here’s why MobalPay is a convenient choice:

- No Bank Account Needed: You don’t need a Japanese bank account or phone number to apply.

- Easy Application: Apply with a valid residence card, Japanese driver’s license, or Diplomatic ID card.

- Convenient Top-Ups: Easily top up your card at convenience stores using cash.

- Multiple Payment Methods Available: Use it for online shopping, in-store payments, QR code payments, and barcode payments.

- Works with Japan’s existing payment apps: MobalPay is compatible with PayPay, Rakuten Pay, dBarai, et

How To Apply for MobalPay?

Simply go www.mobalpay.com and start the application process.